Growing Demand for Baby Swimming Lessons, STA Survey Reveals

But could the lack of UK pool time availability and pool space cap the growth of this thriving industry?

The private swim school sector is a thriving, multi-million pound market in the UK, having grown enormously over the past decade.

It teaches hundreds of thousands of children to swim every year and continues to dominate the baby swimming market.

Although baby swimming has been around for many years, it is only in the last 10 – 12 years that its popularity has grown to the extent that it is now a mainstream activity. As a result, the private swim school sector has flourished and now delivers the majority of all UK learn-to-swim programmes.

But has baby swimming reached its peak in the UK?

As the lead awarding body for baby swimming teaching in the UK, STA reports that there is no sign of it wavering yet.

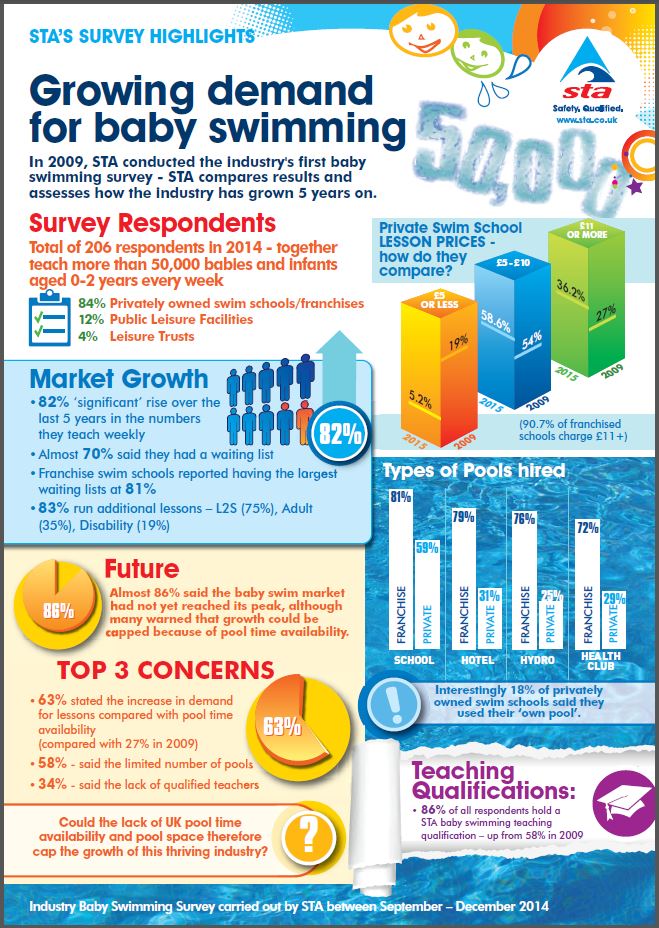

In its second nationwide industry survey since 2009, STA reports that 82% of the swim schools who took part in the research said they had seen a “significant” rise over the last five years in the number of babies (youngsters aged two and under) they teach weekly.

Almost 86% of the 206 respondents also said the baby swim market had not yet reached its peak, although many warned that growth could be capped because of pool time availability.

More than half admitted that the increase in demand for lessons compared with pool time availability was a concern; while a further 58% said a limited number of pools also gave them cause for concern. Just over one third (34%) also cited a lack of adequately qualified teachers as a problem for their business, compared with 24% five years ago.

On a positive note, 60 new swim schools are reported to have opened since the last survey, a growth of just over 27% in five years, and almost 70% of all respondents said they had a waiting list for baby swimming classes, down slightly from 77% in 2009. Franchise swim schools were cited as having the largest waiting lists at 81%.

Zoe Cooper, Head of Accounts at STA, said: “The landscape has changed dramatically since we conducted our first survey five years ago but this survey has shown us that there is still a growing and healthy demand for baby swim teaching and that can only be good news.

“Parents clearly recognise that it is important for their babies to gain confidence in the water and by sending them to baby swim lessons, it means their youngsters are being properly prepared for more formal swimming lessons.”

She added: “It’s also encouraging to see how privately owned swim schools have matured and are growing their businesses, with 83% stating they run additional sessions to baby swimming, including learn-to-swim programmes (75%), adult (35%) and disability (19%) sessions and AquaNatal (8%).”

Other key findings from the survey

Class Sizes

- The majority of baby swim classes run with six to ten learners in both the 0-18 months (73%) and 18 months-2 years (68%) age ranges.

- Since 2009, there has been a slight drop in the number of larger classes of 11 and more learners – in 2014, there were just over 5% of classes for larger groups for 0 months to two years, compared with 13% in 2009.

Number of Weekly Lessons

- The survey showed that swim schools have increased the numbers of baby swimming sessions they run each week.

- Almost 20% run between 11 and 20 classes (up from 13% in 2009), while just over 11% offer between 21 and 30 sessions (6% in 2009). There has been an almost trebling in the number of swim schools offering between 31 and 40 lessons between 2009 and 2014 – 5.83% compared with 2%.

Lesson Prices

- 58.6% of privately owned / franchise swim schools charge between £5 and £10 for a 20-30 minute lesson (up from 54% in 2009).

- 36.2% charge £11 or more (up from 27% in 2009) – the majority (90.7%) are franchised swim schools.

- 5.2% charge less than £5 (down from 19% in 2009).

Teaching Qualifications

- 86% of all respondents confirmed that they held a STA baby swimming teaching qualification – up from 58% in 2009, demonstrating that STA continues to lead the market.

Types of Pools Hired by Franchise and Privately Owned Swim Schools

- School pools – franchised swim schools 81.39% / private swim schools 59.5%

- Hotel pool – franchised swim schools 79% / private swim schools 31.4%

- Hydro pool (health setting) – franchised swim schools 76.70% / private swim schools 24.8%

- Private health club pool – franchised swim schools 72% / private swim schools 59.5%

Interestingly 18% of privately owned swim schools said they used their own pool.

“This survey has highlighted some extremely interesting statistics about the private swim school sector and I would not be at all surprised to see more schools taking the step of building their own pools to cope with the increase in demand,” concluded Zoe.

Notes

In 2009, STA conducted the industry’s first baby swimming survey, and now 5 years on, STA circulated the same questionnaire to UK swim school owners and operators to compare results.

- Industry Baby Swimming Survey carried out by STA between September – December 2014

- Total of 206 respondents in 2014

- Together teach more than 50,000 babies and infants aged 0 – 2 years every week

- Breakdown of 2014 respondents:

- 12% public leisure facilities

- 59% privately owned swim schools

- 21% franchises

- 4% leisure trusts

- 4% other

- Categories

- Swimming Teaching