An Evolving Era for Baby & Pre-School Swimming

Zoe Cooper, STA’s Commercial Director examines the findings from the recent 2023 baby swimming survey, the first one since the pandemic, and shares 5 insights into why the delivery and organisation of baby and pre-school swimming lessons has, and continues to evolve for many swim school businesses.

For background, more than a decade ago in 2009, STA conducted its first benchmark survey into the baby swimming market, which was followed up 5 years later (late in 2014) with a replicated second survey with the results published early in 2015. The plan was to follow this up again in 2020, but we all know what happened then and since with rising fuel costs and the cost-of-living crisis.

It’s been a really difficult few years for the aquatics industry, so we wanted to resurrect the baby swimming survey in 2023 to understand how the baby and pre-school swim sector specifically has been impacted, with the idea of comparing the results to the previous two surveys in 2009 and 2014.

However, the fact is, the baby and pre-school swimming industry is not the same as it was back in 2014, and certainly not like it was in 2009 when it was a relatively new market. The results of the 2023 survey have served to prove what we thought; it is now very much a mature market and as such it has evolved and changed – and as the saying goes, “you can’t compare apples with pears”.

The survey however, has given us the data to be able to question and open up more in-depth conversations with swim school owners. Yes, there are some elements we can continue to benchmark, but external factors such as COVID, rising energy costs, swimming teacher shortages, swimming pool closures and the cost of living have served to change how many swim schools manage and organise baby swimming lessons. And, unlike in previous survey years, there are very few ‘normal’ trends or patterns to report in 2023. Why? As the private baby swimming schools in our focus group said “it’s because these are not normal times, and swim schools have needed to adapt to these external factors, and in their own way be creative in response to what customers want, while also balancing their own business in these difficult times.”

STA’s FIVE Insights from the 2023 Baby Swimming Survey

Before we get into the detail, we’d just like to qualify and positively confirm that the baby and pre-school swimming market in general remains buoyant with more than half of the swim schools surveyed saying they have increased the numbers they teach on a weekly basis. The focus group members we engaged with following the survey, did however say there are regional variances; and the reality is, is that some areas are prospering and in others, some are struggling to fill the younger baby age group classes. It’s clear each region has its own needs and demands, and in this 2023 survey, the top three regions where private swim schools stated they’ve not seen any growth in the last five years are in the South East, South West and Yorkshire – however for context, these regions did represent more than half of all the respondents who completed the survey.

Survey Participants

288 swim school providers took part in the 2023 survey, who together teach more than 50,000 babies and infants every week. 82% of the respondents operate in the private baby swimming market, with 26% operating baby and pre-school swimming lessons in the public sector.

About the Respondents

- 93% hold a recognised baby swimming teaching qualification, with 6% saying they hold a Level 2 swimming teaching qualification (1% didn’t know).

- 79% hold a STA baby swimming teaching qualification

- 57% also hold a Level 3 baby swimming teaching qualification.

Insight One: Age Groups

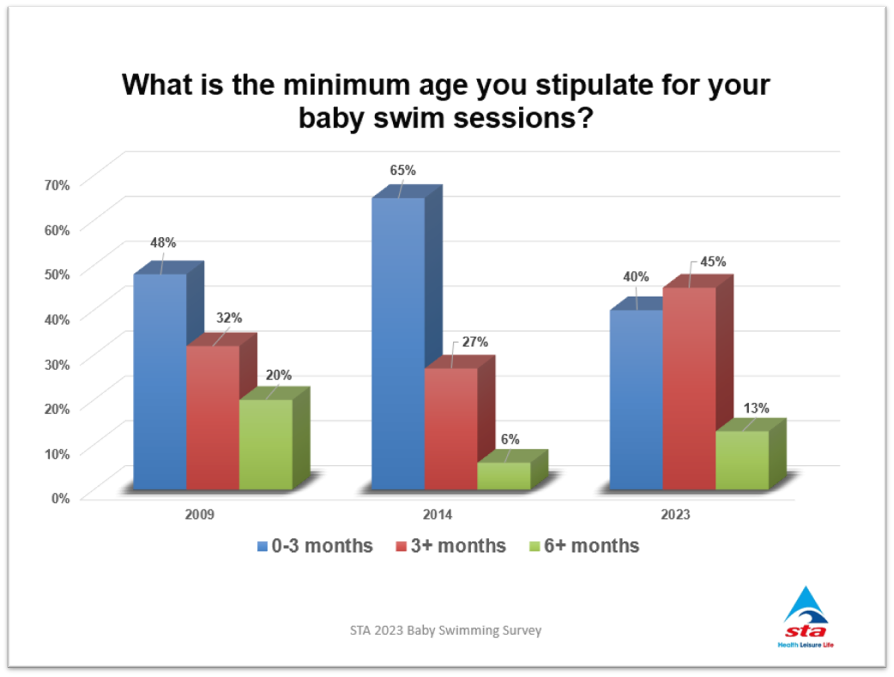

In 2014, two-thirds of swim schools provided baby swimming lessons from age 0-3 months; that figure according to this survey has now dropped by 25% in 2023. With the majority now starting at 3 months +.

Why?

There is no one factor, but the swimming schools we spoke to after the survey said:

- With pool space at a premium, they are focusing lessons where the demand is – from 3 months

- There has been a marked growth in parents doing more water-related activities in the bath at home (likely a consequence of the availability of all the online videos that were produced during the pandemic to keep parents engaged when pools were closed – and TikTok), so parents are not in a rush to take a young baby swimming

- Parental concerns

- Lower pool temperatures

- Cost of living = cost of sessions

- Rise in parents wanting to bring siblings along to sit on poolside whilst they are in the water, which is not always practical, as they cannot afford the extra childcare

- The ‘hygienic’ effect of COVID – interestingly swim schools cited that more and more parents are now asking to inspect changing rooms before enrolling. With the facilities too, parents want to know if they can park nearby; they want everything to be quickly accessible.

Insight Two: Numbers – Classes / Participants / Class Sizes

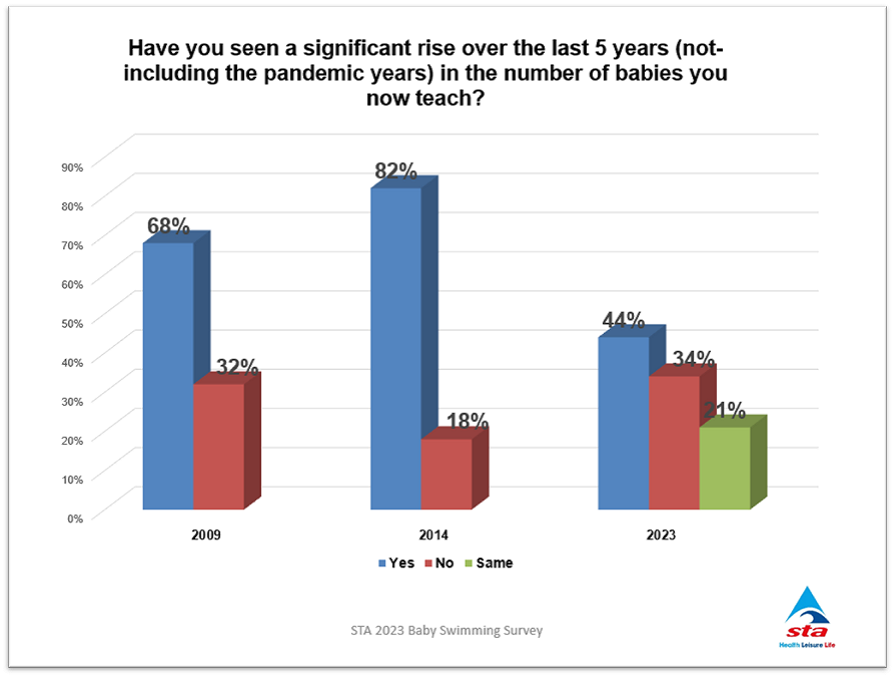

The results of this initially were not wholly inclusive, as statistically it suggested that the majority of swim schools (more than 50%) now only deliver 1-10 classes per week, and tied to this there are marked decreases in the number of 50+ participants being taught per week.

You could conclude in the public sector, they have reduced the number of classes because of lowering pool temperatures or in the private sector because of reduced pool space – and in both sectors because of swimming teacher shortages.

The data though conflicted with the growth patterns, with 44% of respondents confirming they had seen a significant rise over the last 5 years (not-including the pandemic years) in the numbers they now teach. So, we put the question to the focus group who revealed that yes, all of our conclusions are a factor, but also that there has been a drop-off in numbers in the under-2 years age bracket due to the cost-of-living issues in some regions with ‘baby’ swimming being seen as a ‘luxury’; but in most cases this seems to being counter balanced with good numbers in the 2-4 years age group where there are bigger class sizes.

This concurred with the question on class sizes, which revealed that in the higher pre-school age groups, class sizes have got bigger – the majority are 6-10 participants in every class, but there was also a 16% increase in the number of swim schools teaching 11+ pre-schoolers in one class.

Conversely, the survey also showed huge increases in small class sizes across all the age groups. It shows growth in bigger class sizes and in smaller class sizes – no in-between this year based on these results. So, we were curious and questioned the private swim schools in the focus group on why the huge growth in smaller class sizes, they said:

- The rise in using private residential pools – concurring with the results of the ‘type of pool’ private swim schools use, with more than 15% saying they now use private residential pools

- Swim schools building their own pool (22% confirmed they use their own pool) and generally these will be smaller pools because they are more cost effective to run

- Parent demand – again an over-hang from COVID with parents wanting smaller class sizes

- They also said in some cases because of limited pool space, many are now running up to 4 smaller classes at one time in the pool to maximise space, profitability, and in response to parents wanting smaller class sizes – in the statistics this would have been classified as ‘one’ session, so would explain the growth patterns recorded.

Insight Three – Cost of Swimming Lessons

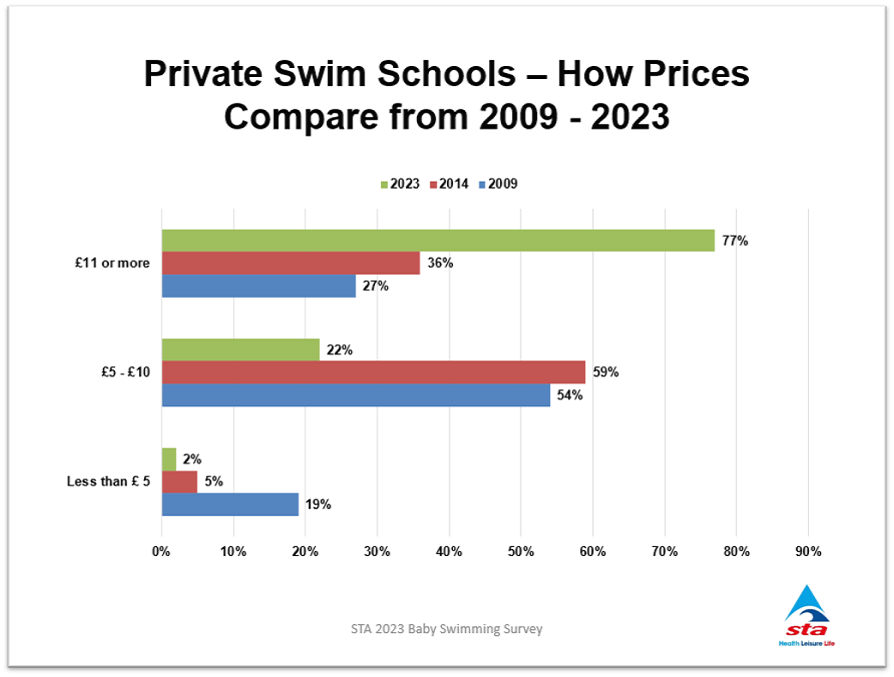

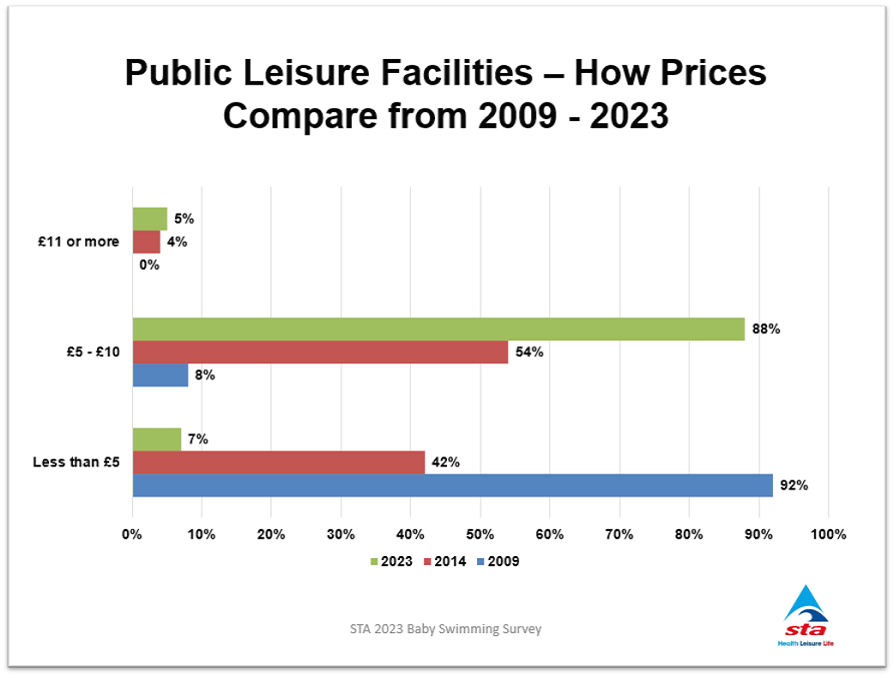

It will come as no surprise that the cost of baby and pre-school swimming lessons in 2023 has increased since 2014 and 2009.

- In the public sector – the majority is £5-10 a lesson – a jump overall of 80% in the £5-£10 bracket since 2009

- In the private sector – the majority is £11+ per lesson – a jump overall of 50% in the £11+ bracket since 2009

The focus group made up of private swim school owners, commented:

- When comparing sectors there is not a level playing field with private swim school lessons having to pay VAT and the public sector exempt – and when parents in a cost-of-living crisis cannot afford lessons, this is exasperating the private swim school market

- More and more parents of babies under 12 months are staying for a term or a two, but are then dropping out because of cost and are either going to their public leisure centre for lessons or taking them themselves – many will return to lessons at the child’s next development stage as they recognise the importance of their child learning to swim and gaining the fundamental skills

- Cost of living again is a huge factor – with parents skipping the baby phase and going straight into toddler learn to swim lessons

- The 2021 stamp duty frenzy is also now making an impact, with people’s two-year fixed mortgages now coming to an end, and are facing further increased costs – hundreds of pounds to a monthly mortgage repayment

- The knock-on effect of cost as well, is there is also a greater need for ‘results’ to be produced quickly – parents choose swimming because they understand the importance of ‘water safety and personal survival skills’ but they want to spend less money and less time at lessons. The majority of parents are no longer in this for the ‘journey’, it’s a means to an end. Consequently, it seems they are also less brand loyal – cost, convenience (time of lessons) and location are important factors when choosing a baby and pre-school swimming provider.

Insight Four – Waiting Lists

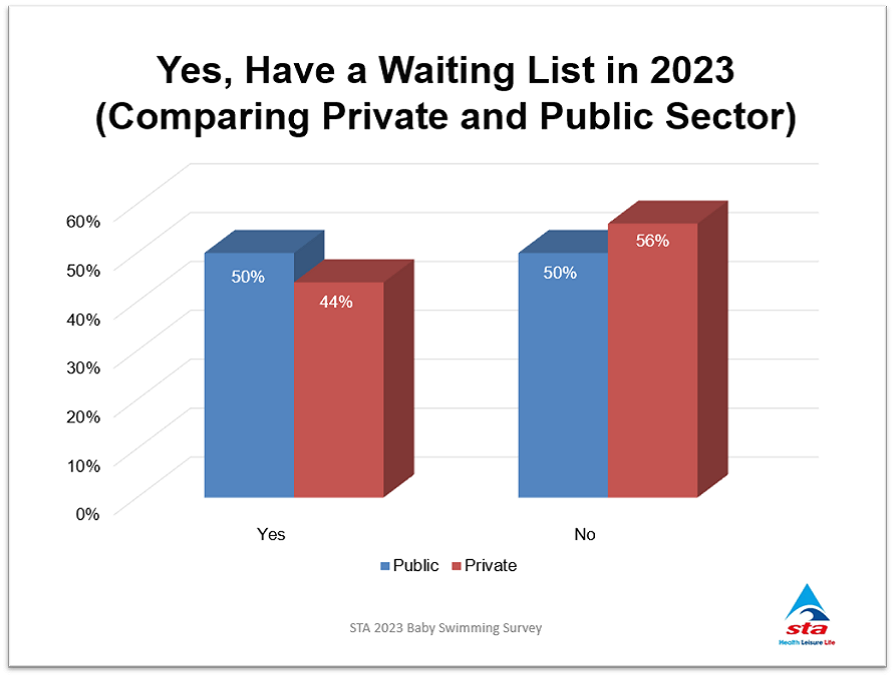

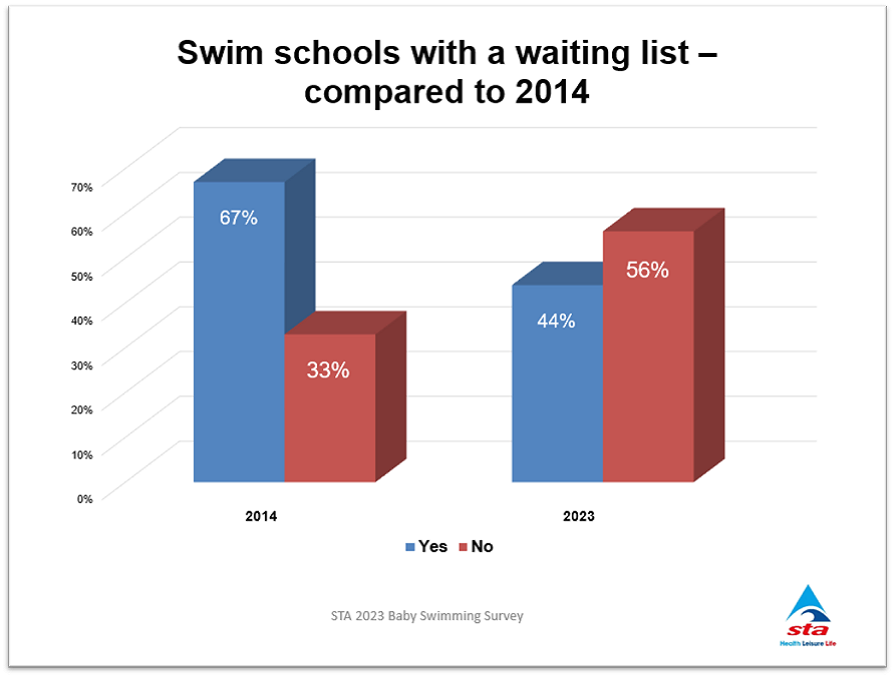

50% of the public and private swim schools said they have a waiting list, and when discussed in the focus group, they provided further insight:

- Mums who in the majority (85%) take babies to swimming sessions are returning to work much earlier because of the cost of living, so the waiting lists in their schools are mainly for weekend slots

- Waiting lists are for the 2/3/4 years lessons – and again week day sessions for working parents are not viable

- Demand for small class sizes vs. pool space

- Struggle finding pools at the right temperature for babies

- Swimming teacher shortages.

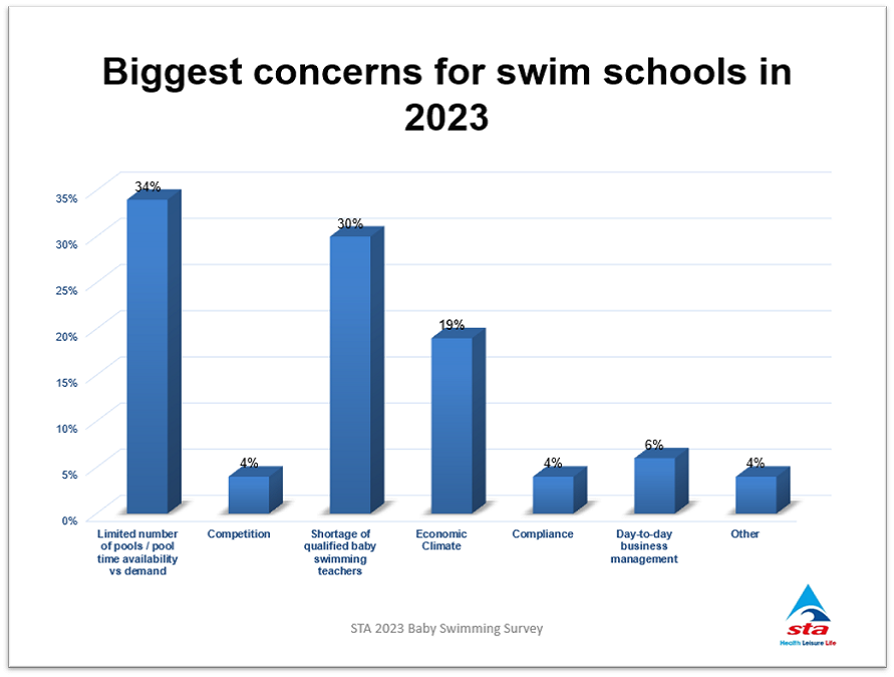

Insight Five: Biggest Concerns for Baby and Pre-school Swimming Providers

The three top answers in order were limited pool space and availability, shortage of qualified baby swimming teachers, and the current economic climate.

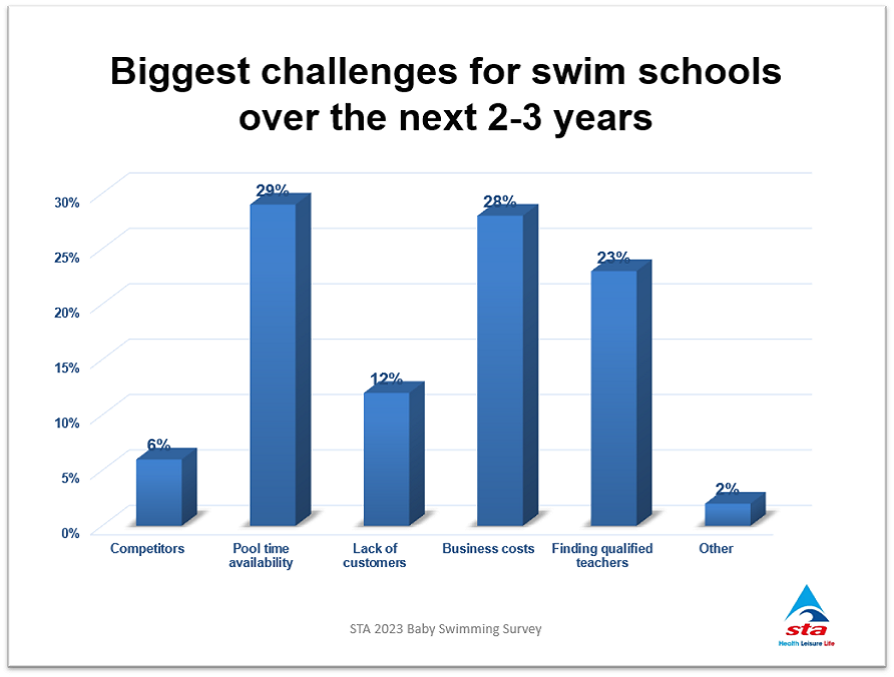

In summary, while generally the baby and pre-school swimming market is continuing to grow, the key takeaways from this survey and with the input from the focus group, is that we have seen two significant changes to the way lessons are being organised.

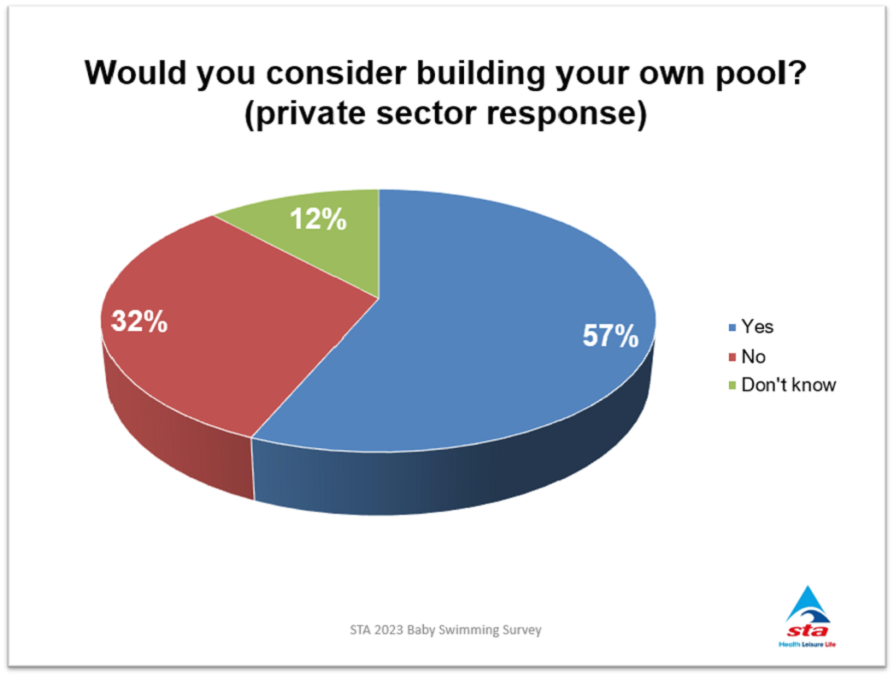

On the one hand we have bigger class sizes with a more driven focus on the 2/3/4 years plus market to maximise pool space and because of teacher shortages and the cost-of-living crisis. And, then at the other end of the scale in the private swim school market, we have seen a growth in smaller classes in response to parent demand and the growth in private residential and own self-build pool usage – the latter is also expected to grow even further, with more than half of respondents saying they would consider building their own pool in the future.

The other key learning from this survey is that the baby and pre-school swimming market has evolved so much since 2009, not only in terms of the way baby swimming is taught, but in the way it is being organised, and in the private swim school market where its being delivered. Right at the beginning we said you can’t compare apples with pears, and while this survey started out more than decade ago as a way to benchmark the industry, so much has happened in the world since, and there are so many more factors to now consider. Therefore, moving forward, we are going to use the results of the 2023 survey to make a fresh start, and with things moving apace in the world, we will conduct another comparative survey in a year’s time.

- Categories

- Association News, Swimming Teaching